अपनीं वेल्थ और नॉलेज को बड़ाने वाली गाइड के लिए DM WEALTH के साथ जुड़ें

“I will keep posting more important posts on my Website for all of you. Please give your support and love”

Wealth By DM

इस ब्लॉग पर में आपके लिए वो कंटेंट लाता हूँ, जो आपकी wealth & नॉलेज को बडाने में आपकी बहुत हेल्प करतें हैं। और यह एक Professional Education Platform है जहाँ आप interesting content’s जैसे Stock Market, Technology, Blog Contents And Wealth Created Idia’s Hindi में पड़ सकतें हैं।

मैं सीखना चाहता हूँ?

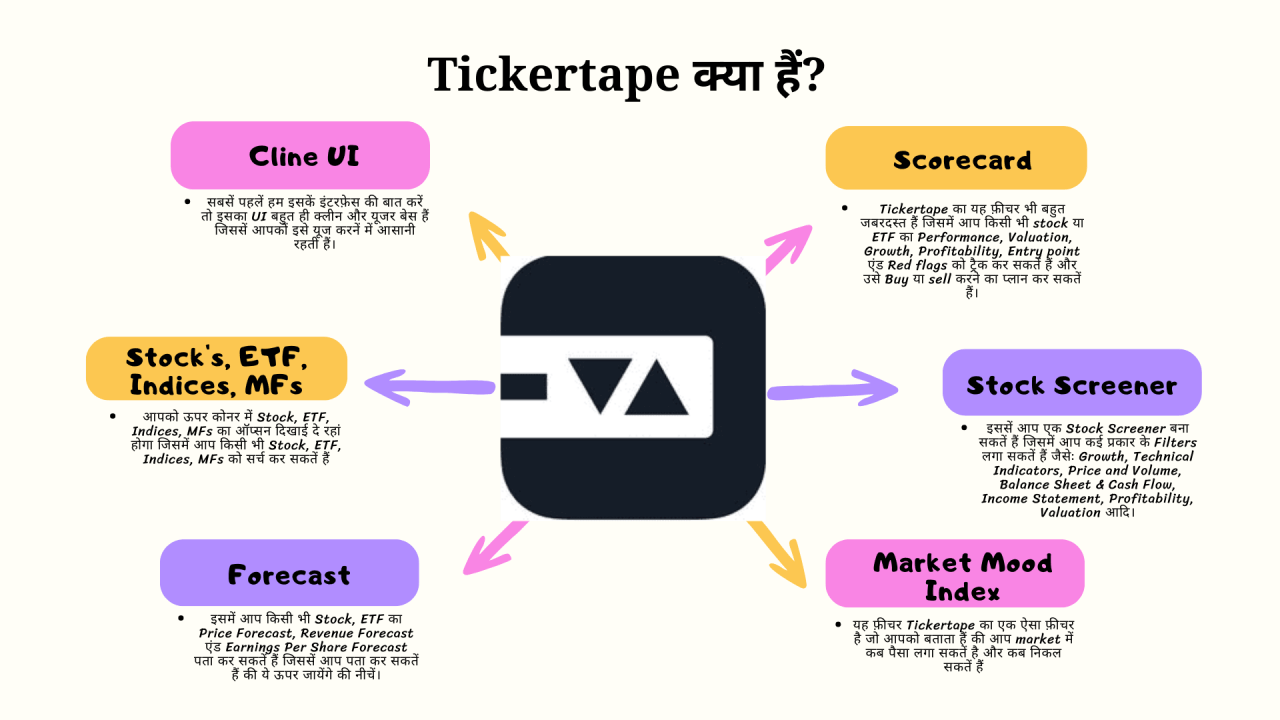

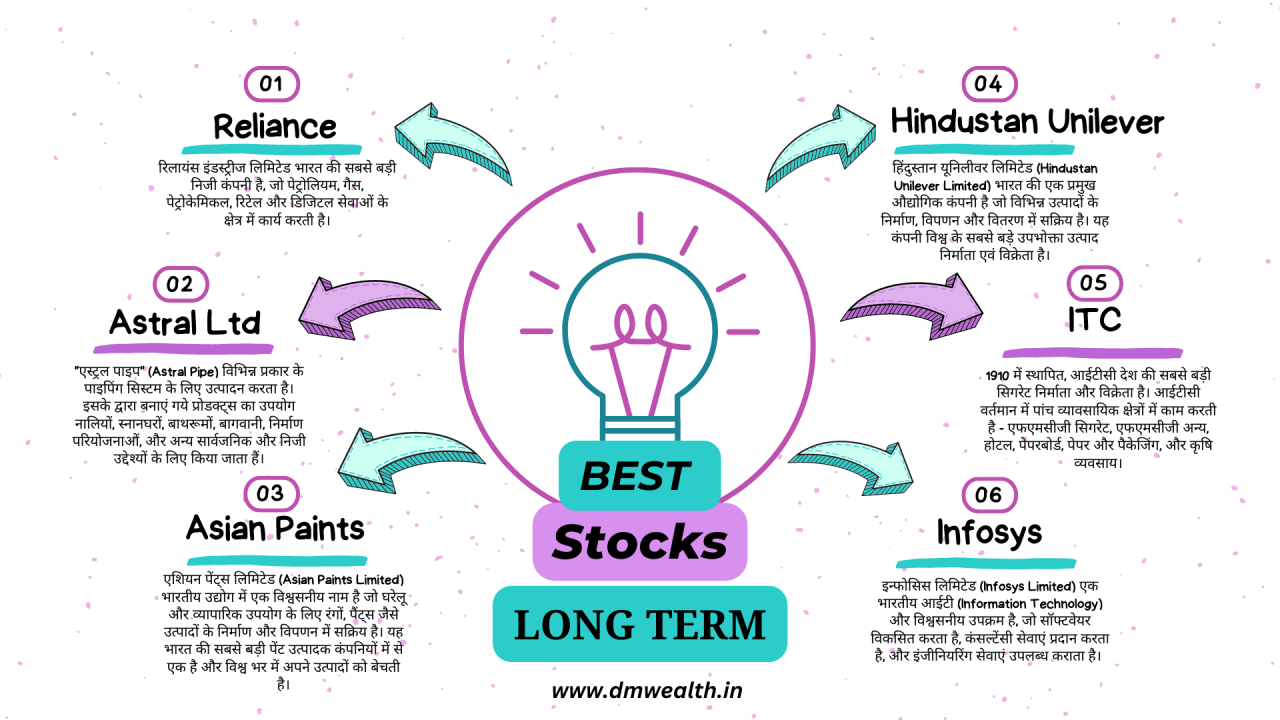

शेयर मार्केट

शेयर मार्केट के बारें में जानें और सीखकर इससें पैसा कमाना स्टार्ट करें और अपनीं वेल्थ को बडाये।

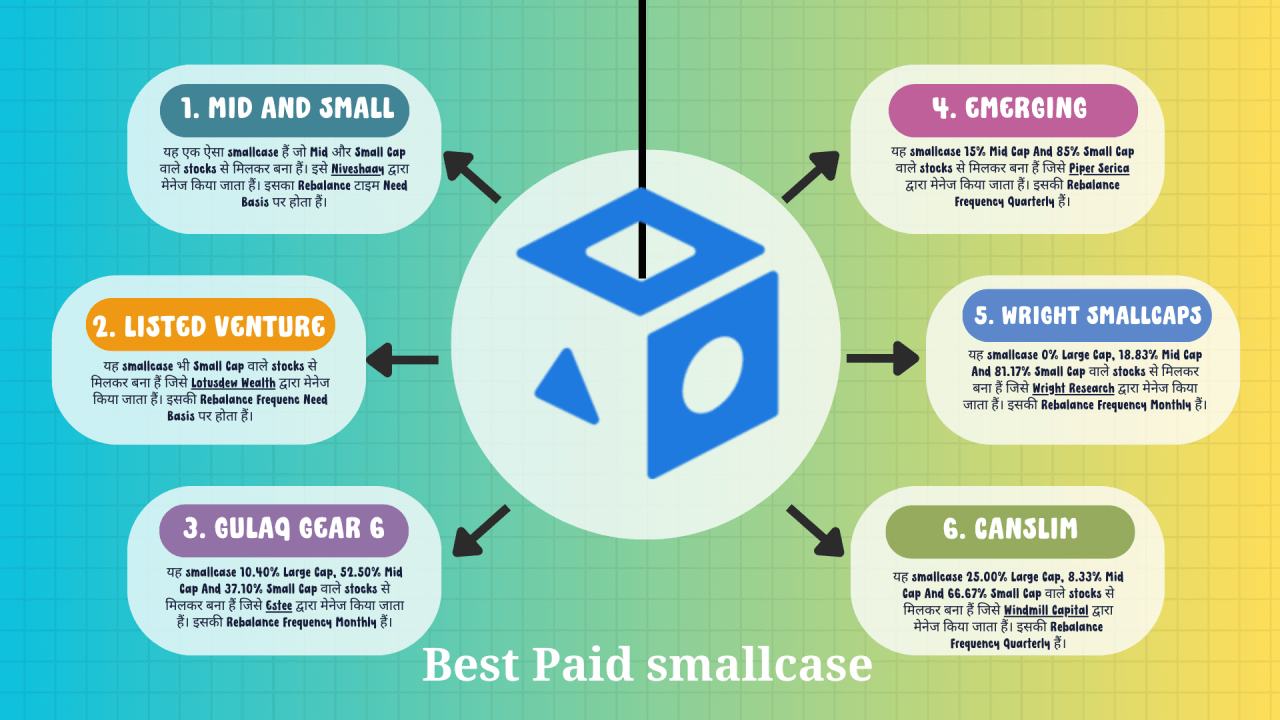

स्मालकैश

Smallcash क्या होता हैं? इसके द्वारा आप शेयर मार्केट में invest कैसे कर सकतें हैं।

आईपीओ

IPO क्या होता हैं? IPO से पैसे कैसे कमा सकतें हैं? इसकी पूरी जानकारी के लिए यहाँ पर click करें।

पैसा कमाना

ऑनलाइन पैसा कैसे कमायें हैं ? कोन-कोन से तरीकों से पैसा कमाया सकता हैं।

वेब होस्टिंग

Web Hosting क्या होती हैं? यह कितने प्रकार की होती हैं? आपकें लिए बेस्ट web hosting कोनसी रहेंगीं।

बेस्ट

यहाँ आप को बेस्ट डील, ऑफर, प्रोडक्ट, बेस्ट वेबसाइट & QUALITY कन्टेंट मिलने वाले हैं।